HDFC Standard Life Insurance, one of the top three private life insurers in profitability, on Tuesday launched its Rs 8,695-crore initial public offering (IPO), the biggest so far in the country’s life insurance sector.

The price band for the offer has been fixed at Rs 275-290 a share. The public issue comprises sale of 191,246,050 equity shares by HDFC, amounting to a 9.55% stake, and up to 108,581,768 shares, or 5.42% holding, by Standard Life Mauritius.

While the company raised Rs 2,322 crore from anchor investors on Monday, should you put your money in the offer as a retail investor, especially given that that valuation is on the higher side? ‘Subscribe’, but with a long-term horizon, suggest most analysts.

At present, HDFC holds 61.41% and Standard Life 34.86% in HDFC Standard Life, while the remaining shares are owned by employees and PremjiInvest.

Here is what broking firms are saying about the issue:

Motilal Oswal Securities

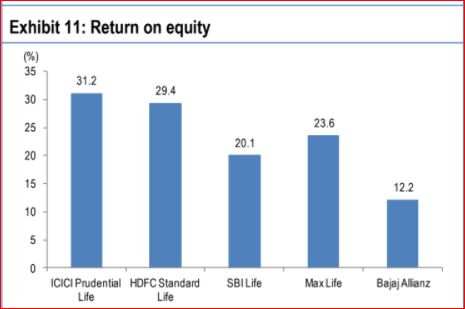

We are positive on HDFC Life for the long term as the life insurance sector in India provides huge opportunities for growth. HDFC Life has delivered premium income/PAT growth of 14%/19% in FY13-17. Further, the company has consistently delivered strong ROEs in excess of 21% for last 5 years. At the upper price band, the issue is priced at a price-to-book-value (P/BV) of 15.2x and price-to-embedded-value (P/EV) of 4.1x (FY17) after the issue.

While the valuation looks high when compared with other listed financial companies (NBFCs, insurance and private banks), we believe premium valuations are justified due to a number of reasons. First, there is a huge potential for growth as insurance in India is highly underpenetrated. Second, the company has shown a strong financial performance with consistent and profitable growth. Third, a focus on customer centricity has enabled growth across business cycles. Fourth, the company has had a consistently growing multi-channel distribution footprint. And fifth, the company has had consistent and strong ROEs. So, we recommend 'SUBSCRIBE' for long-term investment.

Prabhudas Lilladher

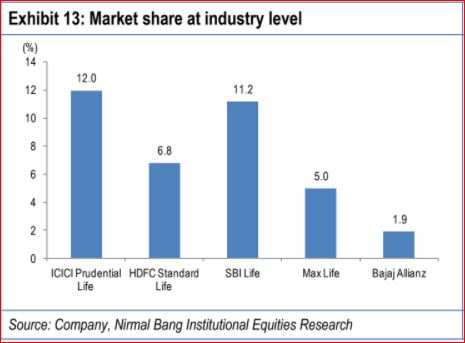

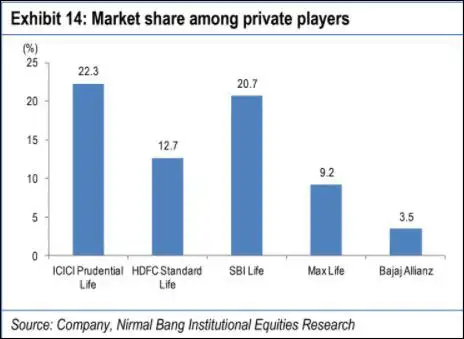

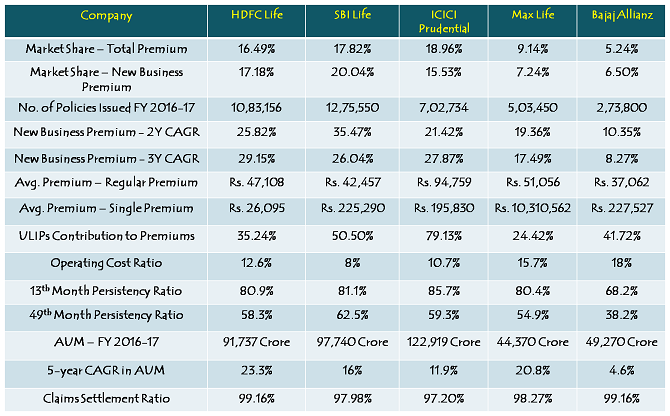

HDFC Standard Life Insurance is the most profitable life insurer based on value of new business (VNB), with VNB margin at 22% in FY17. It enjoys a market share of 6.8% in FY17 at industry level (12.7% among private players) and they also have the most balanced product mix with ULIP constituting only 35% of the total NB basis. HDFC SL has a high share of protection business (the most profitable business segment) at 26.4% of total NB in H1FY18 and focus to increase further.

We believe Operating RoEV to improve to 23‐24% (22% currently) and VNB margins to 24% by FY20. At the upper end of the price band of Rs290, the company would trade at 2.8x Sep‐19 P/EV which we believe is fairly priced and hence we recommend to 'SUBSCRIBE' for long term gains.

Angel Broking

At the upper band of Rs 290, the issue is valued at 4.2x of 2QFY2018 embedded value (EV) of Rs 14,011 crore, bit higher than close listed player SBI Life and ICICI Pru which is trading at 3.6x and 3.3x of 2QFY2018 EV, respectively. However, we believe slight premium is justifiable, considering, consistent growth across premium categories, improving dividend payout over last four years, strong parentage, trusted brand name, highest VNB margin (22% for FY2017) and well balanced business mix. Based on the above positive factors, we assign 'SUBSCRIBE' rating to the issue.

Centrum Wealth Research

At the higher end of the price band of Rs 290, the issue is priced at 4.7x its FY17 embedded value & 4.2x its Sept’17 EV (listed peers ICICI Pru trading at 3.4x its FY17 EV & 3.2x Sept’17 EV and SBI Life at 3.9x & 3.6x, respectively). At this valuation, while the issue seems richly priced, the company is leading in most of the parameters. Going ahead, the company is expected to benefit largely from financialisation of household investments, under-penetration of insurance in India, vast bancassurance and private agent network along with its extensive reach and market share.

We believe the company will be able to attract adequate investor interest on the basis of its robust fundamentals compared to peers and strong parentage. Given the mature valuations, investors can 'SUBSCRIBE' to the issue from a long term perspective. It must be noted that since the issue is being offered at expensive valuation, it may not attract major listing gains.

Risk factors:

* Any termination/change in bancassurance arrangements or decline in performance of bancassurance partners may adversely affect the business and financial condition

* Liquidity risk to the company’s investment portfolio.

Geojit Financial Services

The untapped opportunity and lower penetration in life insurance provides ample scope for the company to grow its portfolio at a rapid pace. HDFC Life had an

An EV of Rs 14,010 crore as on H1FY18 with an operating RoEV of 21% (EV is a common valuation measure in the insurance industry which measures potential future profits from existing business).

At upper price band of Rs290, HDFC Life is available at P/EV of 4.2x on H1FY18 EV, which is steeper compared to its peers. However, its higher growth and better profitability may justify the premium valuation. We recommend 'SUBSCRIBE' to the issue only with a long-term perspective given high valuation.

Charts

HDFC Standard Life’s financial performance (in INR crore)

| ||||||

| FY2013 | FY2014 | FY2015 | FY2016 | FY2017 | H1 FY2018 | |

| Premium earned | 14,016.3 | 17,290.7 | 27,090.6 | 18,066.5 | 30,554.4 | 14,415.0 |

| Profit after tax | 447.7 | 725.3 | 785.5 | 818.4 | 892.1 | 554.9 |

| EPS (INR) | 2.24 | 3.64 | 3.93 | 4.10 | 4.44 | 2.80 |

Peer Comparison :

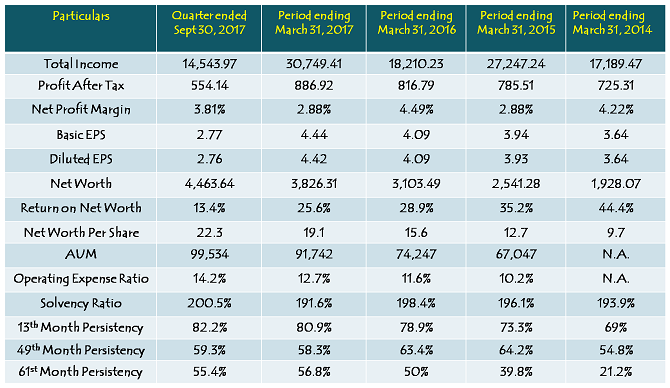

Financials of HDFC Standard Life Insurance Company

IPO Details :

HDFC Standard Life Insurance IPO details

| |

| Subscription Dates | 7 – 9 November 2017 |

| Price Band | INR275 – 290 per share |

| Fresh issue | Nil |

| Offer For Sale | 299,827,818 shares (INR8,245.26 – 8,695 crore) |

| Total IPO size | 299,827,818 shares (INR8,245.26 – 8,695 crore) |

| Minimum bid (lot size) | 50 shares |

| Face Value | INR10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Conclusion :

After reading all the review, due to lack of near term triggers, Premium valuations, Poor performance of recent listed Insurance IPO's, suggest that there will not be immediate returns i.e. listing gains. However one can invest only with long term perspective.

Information courtesy :

Economic times, Business Standard, IPO Central, Onemint.

Comments

Post a Comment